In recent years, finance teams have started moving away from traditional corporate cards in favor of modern payment solutions that offer better control, visibility, and flexibility. While corporate cards once represented the gold standard for business spending, their limitations are becoming more apparent in a fast-paced, digital-first economy. Today, companies of all sizes are exploring corporate card alternatives that better align with modern workflows, compliance needs, and employee expectations.

The Problem with Traditional Corporate Cards

Traditional corporate cards can be cumbersome to manage. They often come with:

- Limited real-time visibility into spending

- Risk of misuse due to shared card numbers

- Delayed transaction data, making reconciliation slow

- Complex approval processes and paper-heavy expense reporting

For many organizations, these inefficiencies add up to significant time lost for finance teams — time that could be spent on strategic initiatives rather than administrative oversight.

The Rise of Corporate Card Alternatives

The market for corporate card alternatives has expanded rapidly. These options leverage digital-first infrastructure, mobile apps, and real-time transaction monitoring to streamline spend management. Many platforms offer:

- Virtual cards for one-time or recurring use

- Custom spending limits and merchant restrictions

- Instant expense categorization for accounting integration

Instead of waiting weeks for expense reports, finance managers can see spending as it happens, reducing the risk of overspending and fraud.

Benefits of Modern Payment Solutions for Finance Teams

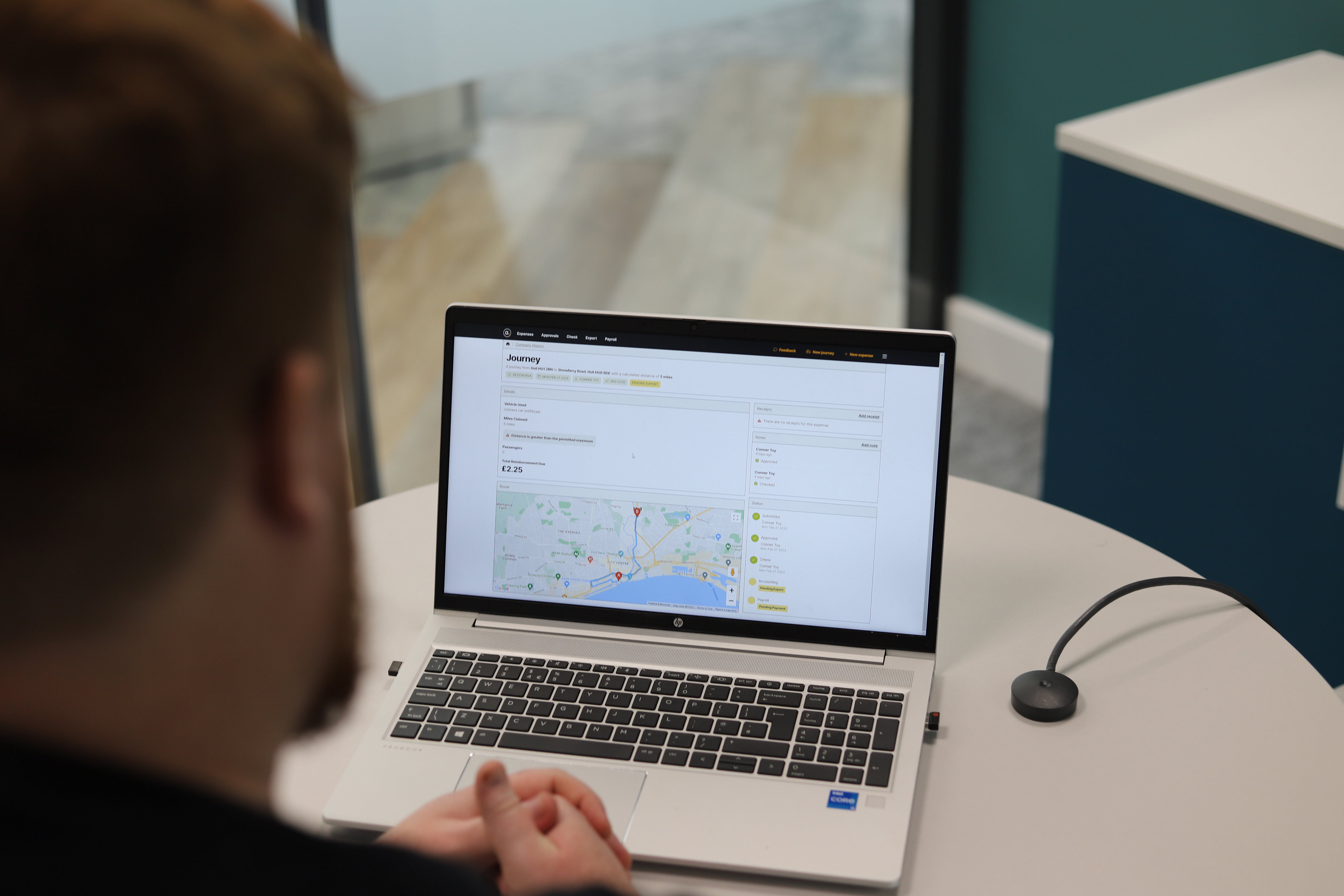

Modern payment solutions aren’t just faster — they’re smarter. They combine payment processing with robust finance team tools such as automated reconciliation, budget tracking, and policy enforcement.

Key benefits include:

- Real-time control: Immediate oversight and ability to freeze cards instantly

- Automated compliance: Built-in approval workflows reduce human error

- Integration with accounting tools: Transactions flow directly into ERP and accounting systems

- Improved employee experience: Easy-to-use mobile interfaces simplify expense submission

By combining payments with financial analytics, modern systems turn what was once a back-office task into a strategic advantage.

The Future of Finance Team Tools

The shift away from traditional cards is part of a broader transformation in how finance teams operate. As companies adopt modern payment solutions, they also embrace data-driven decision-making, faster financial closes, and more transparent reporting.

In the coming years, expect to see even tighter integration between payment systems, budgeting platforms, and forecasting tools — further reducing the gap between spending and financial insight.

Conclusion

For finance teams focused on agility, control, and compliance, traditional corporate cards are quickly becoming outdated. The new era belongs to corporate card alternatives that integrate with finance team tools and deliver the speed, visibility, and flexibility modern businesses demand. By making the switch, companies are not just upgrading their payment method — they’re transforming their entire spend management process.

.jpg)