Are you thinking about using an expense management system to save your business money? You have probably done a fair bit of research by now, and maybe you have a few providers in mind.

For a deeper dive into the expense management solutions on the market, check out our free guide.

And when you look at all the snazzy marketing material, the benefits look amazing, right? Well, they are, but expense management systems are not perfect. If you choose the wrong provider or fail to roll them out properly, you might find yourself wasting money instead of saving it.

At accountabl, we want you to find the right expense management tool for your business and avoid the common issues that companies face. To help you find the right solution, we’ll reveal the truth about expense management systems, why they might not work for you, and what you should look for when you pick a provider.

Failure to perform key functions

Every expense management system is different, and unfortunately some of them can fail to perform key functions. For example, some expense management solutions don’t provide real-time transaction data between the payment card and the system. The absence of real-time transaction data can cause users to forget to upload their receipts, delaying month-end processing. It also removes context from the instant approval process.

Plus, some systems fail to send spending notifications to employees and managers. If expenses are not approved in a timely manner the cardholder can theoretically continue to spend unchecked, which is a problem if their spending is wasteful or inappropriate. Review prompts to managers are a key feature if you want to keep tabs on your spending.

Missing information is another problem that can prevent expense requests from moving forward. Having a system that provides real-time transaction data and sends instant spending notifications, makes it clear what expenses need approval and highlights missing information, which can help to prevent this.

Employees don’t use it

If your team doesn’t use your expense management system then you won’t get a return on investment. How your team uses your expense system is affected by several factors including how well they understand it, how simple the interface is, and the level of customer support.

Proper utilisation depends on a successful rollout. To make sure that you purchase an expense management solution that your team will use, attend demos and look at how user-friendly the interface is, ensure that proper customer support is available, set a rollout deadline to motivate your team, and support staff to use the system.

Cashflow issues

Most systems require you to upload funds into the platform first, which can be a shock if you’re used to the flexibility of credit cards. And you can quickly find yourself in a tough cashflow position, if you don’t account for this you pick your supplier.

To avoid this, manage your cashflow and experience expense success, look for a provider that offers credit with a flexible billing period.

They’re too hard to use

Expense management systems can be complicated and sometimes they fail because they’re tough to use. For example, your staff might find it hard to import data from the expense system into their accounting software. They can also make errors when logging their expenses, which can be tricky to fix.

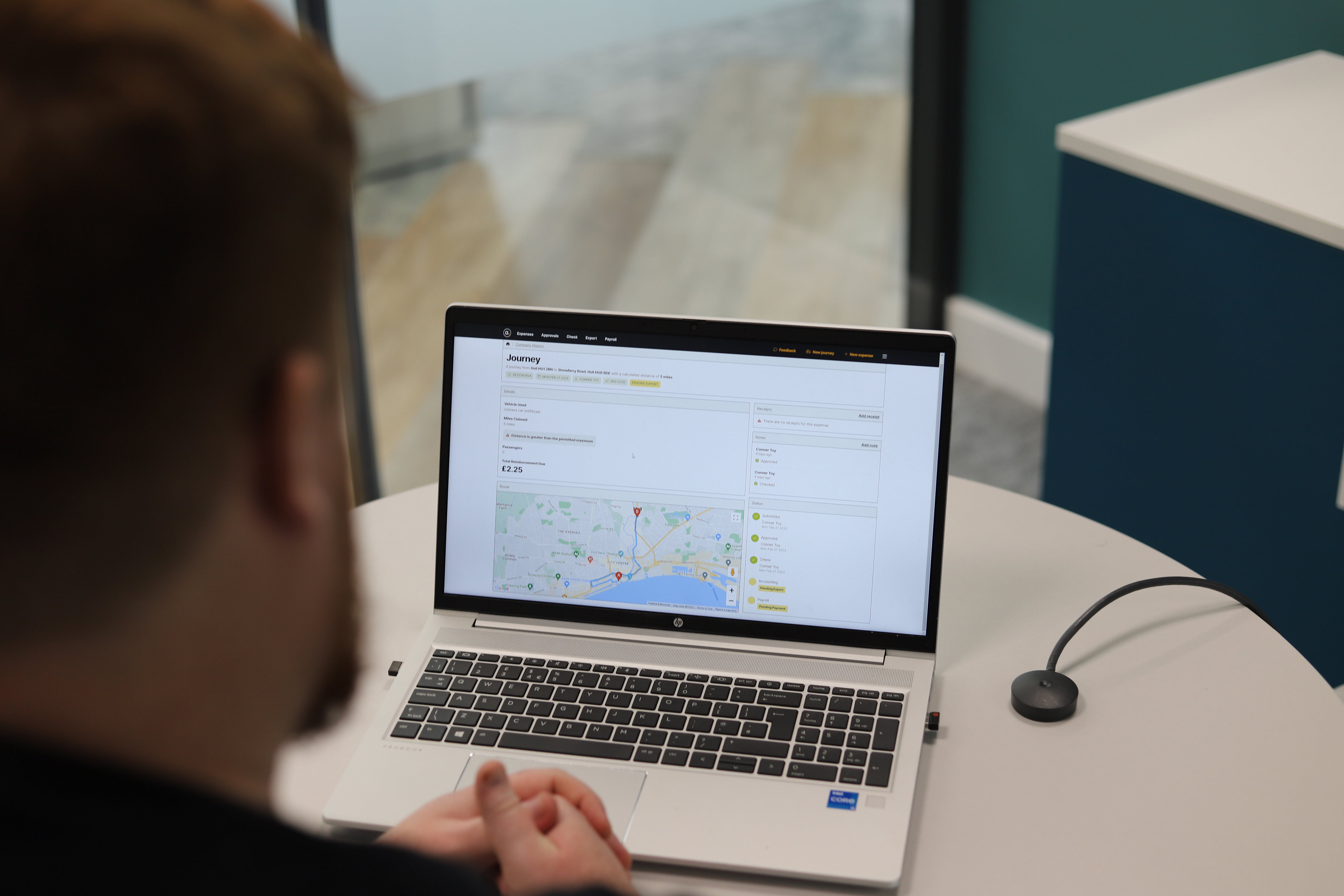

Systems where faulty entries are highlighted and reviewed by users can help you to address problems faster. For best results, you should choose an expense management system with an integrated payment card that provides real-time data, is intuitive to use without extensive training, and has accounting software integrations via a simple export and import process or APIs.

Expense policies are ignored or forgotten

Workers are more likely to make mistakes if they do not know about or understand your company expense policy. To avoid this pitfall, you should look for expense systems that includes your expense policy and advanced features like pre-set spending controls for users, automated receipt collection rules, and receipt compliance checking.

Expense management success

It is obvious that effective expense management systems can save your business serious cash by preventing expense fraud, tracking expenses, reducing waste, and saving staff time.

Unfortunately, expense solutions can let you down. They can fail to perform key functions, can be underutilised, and be too difficult to use. Employees can also fail to read and understand expense policies resulting in too many unapproved expenses.

To manage expenses successfully, you need to choose an expense system with positive reviews, plentiful customer support, product demos, a friendly user interface, a help centre, and regular releases of new and improved features.

At accountabl we want you to experience expense management success, so we offer live customer support with our basic package, including free demos, great new features at no extra cost, instant spending notifications, accounting software integrations, and much more.

Not only that, but we also want you to be able to start your eco-journey without breaking the bank. So, our system tracks the carbon footprint of purchases and user journeys too, so you can empower your employees to make greener decisions.

See for yourself and try accountabl for free with our 30-day trial.