Financial officers and accountants face a complex reality every day: managing budgets, approving expenses, tracking receipts, and ensuring that accounting is always accurate and up to date. Many are familiar with the frustration of chasing missing documentation, handling manual processes, and spending valuable time correcting errors. This is exactly where Accountabl makes a difference.

Tailored payment cards – A new standard for control and efficiency

With Accountabl, financial officers gain access to tailored payment cards directly linked to their control system. Every transaction can be tracked, categorized, and monitored in real time—without compromising user-friendliness for employees across the organization.

Here’s how Accountabl simplifies the workday for finance teams:

1. Automated receipt collection

When employees use an Accountabl card, they automatically receive a prompt to upload the receipt in the app. The system links the receipt directly to the transaction, significantly reducing the number of missing or incorrectly filed documents.

2. Real-time expense control

Cards can be pre-configured with budget limits, project codes, and allowed spending categories. This enables continuous financial oversight—not just retrospective control.

3. Simplified bookkeeping

With properly labeled transactions and attached receipts, accounting entries can be processed almost automatically. Time previously spent on manual data entry and cross-checking can now be directed toward more value-adding tasks.

4. Reduced risk of errors and misuse

By issuing cards with tailored restrictions (e.g., spending limits, geographic controls, or vendor-specific usage), the risk of misuse or incorrect purchases is minimized. This creates peace of mind for both finance departments and employees.

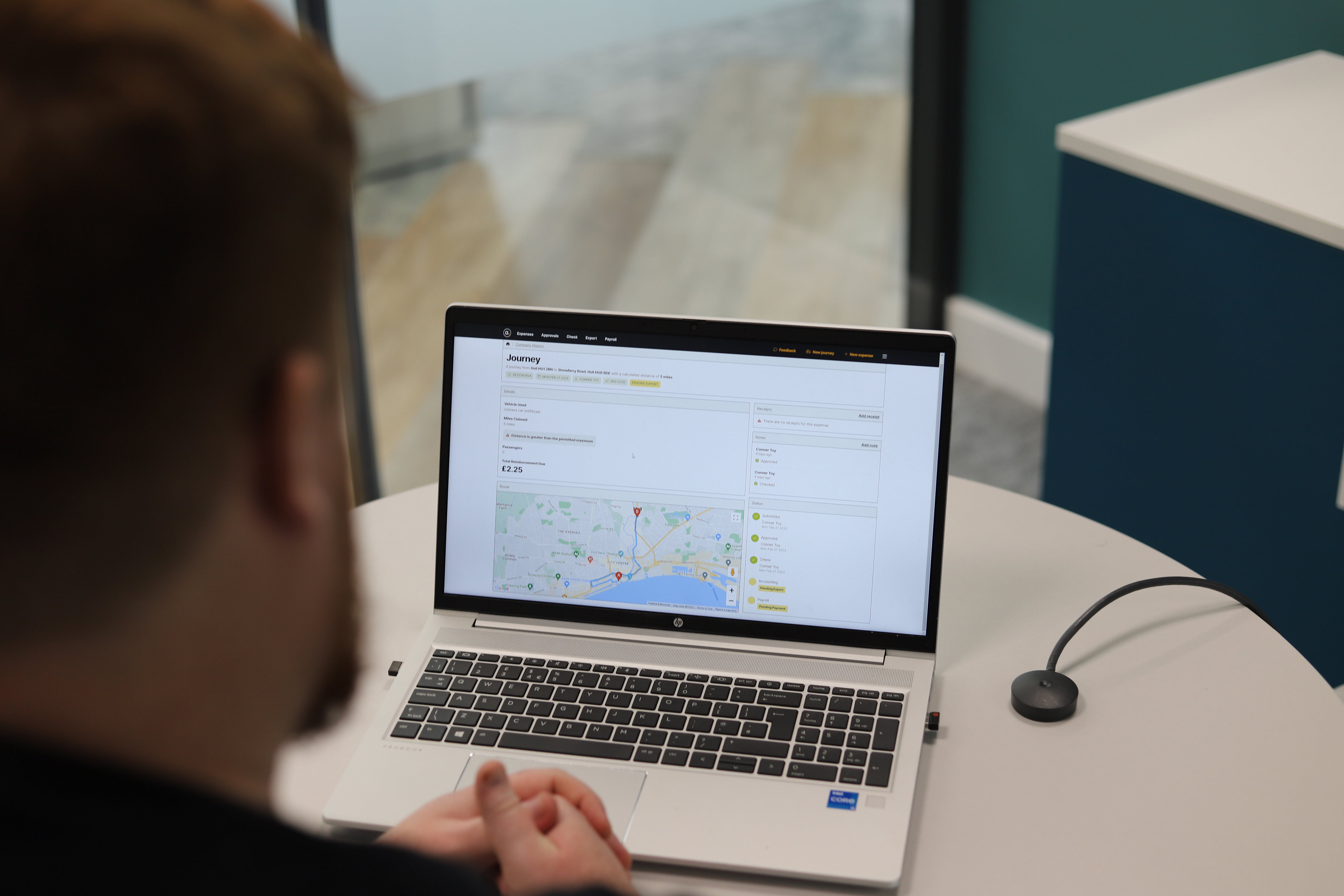

5. Seamless integration with accounting systems

Accountabl integrates with modern financial systems, ensuring that data flows smoothly into the accounting software—without friction. This provides full transparency and reduces the need for time-consuming reconciliations.

From cleanup to control

Traditionally, finance teams have worked reactively—fixing errors, chasing receipts, and spending time on manual checks. With Accountabl, this changes. Finance teams gain tools that allow them to work proactively, with complete insight and control.

For medium and large organizations—where many people make purchases on behalf of the business—this can save dozens of hours each month, while improving accounting accuracy and regulatory compliance.

A smarter tool for modern finance teams

Tailored payment cards from Accountabl are more than a practical solution—they represent a smarter approach to financial management. By combining technology with deep understanding of financial officers’ everyday challenges, Accountabl makes it easier to get things done—quickly, accurately, and with confidence.

Explore accountabl’s smart payment cards for real-time spending control