Yes, you can! Not all fuel cards require credit checks. And even those that do there are still a few options.

The first option if you have a poor credit score might be to place some form of security with a fuel card provider, such as a cross-company guarantee, personal asset statement, or bond payment.

Alternatively, you could consider an upfront payment card, also known as a prepaid fuel card.

But not all fuel and prepaid cards are created equal.

Top-up cards

Traditional prepaid fuel cards are like a standard fuel card where drivers are assigned cards to purchase fuel.

However, there are only a few top-up cards on the market such as FuelGenie or thefuelcardcompany prepaid cards.

With these cards, you’re limited to a very specific set of fuel sites and there are minimum usage requirements.

They need upfront payment each month and include standard fuel card perks like odometer data.

Expense cards

You can also use an expense card as an alternative to a traditional prepaid card. They’re designed for wider business expenses and are used by organisations to facilitate and manage employee spending.

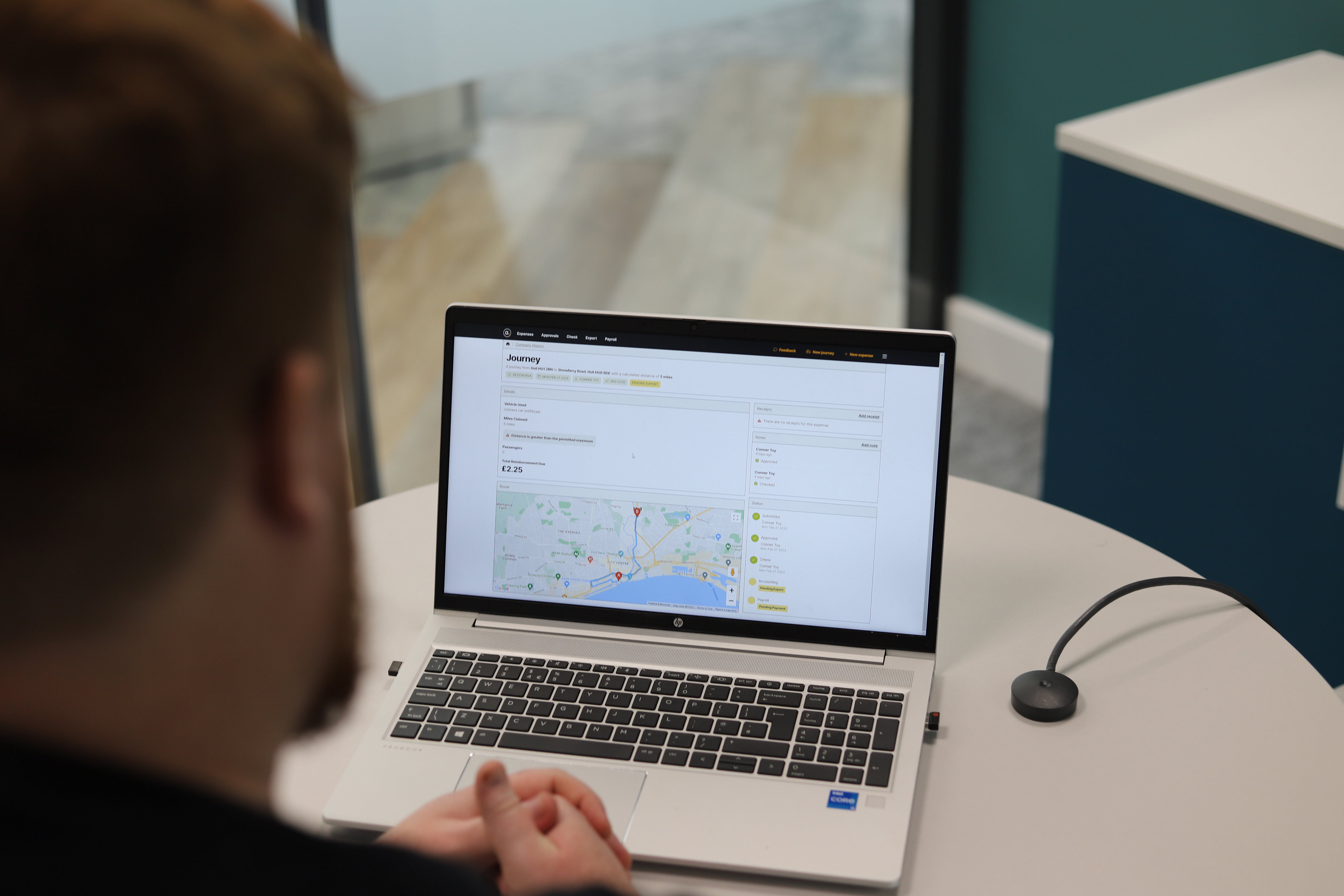

Expense cards work by connecting a payment card such as Mastercard® or Visa to a digital ecosystem.

Purchases are made on the card and are picked up by a mobile app, which users use to submit a receipt and any extra information to their manager for approval.

All transaction data is categorised and readily available online via a dashboard where managers can review spend and accountants can process tax returns.

Aside from the analytics potential, these cards are “smart” because they can be locked down to specific purchase types and spend limits can be applied at card level.

Accountabl is unique in that it offers expense cards with both mileage tracking and a bespoke fuel card journey. So, it's perfect for fleet managers and business owners who want a way to buy fuel without the risk of abuse.

Credit is available at accountabl, but most expense card providers offer prepaid cards where funds are uploaded in advance each month.

Because expense cards utilise Mastercard® or Visa card technology, they can be used pretty much anywhere, including fuel stations ensuring that you get the coverage you need.

Will these cards save me money?

The benefits vary. Traditional prepaid fuel cards tend to offer fixed weekly pricing. So, purchasing your fuel through this method can either be low or high versus the pumps, depending on fluctuations in the oil market.

Because fuel sites purchase large quantities of fuel, it may take them a couple of weeks to replenish their stock, and if the oil prices change, it can save you money or increase costs.

Expense cards, on the other hand, are pump price, so fluctuations in the oil market don’t have the same impact.

You’re not going to make direct savings against the pump price using an expense card. But it can save you money by helping to prevent wasteful spending with real-time data, transaction approval, and spend limits that you won’t find in fuel cards.

It's also worth pointing out, there is no fuel card on the market that offers both global site-wide coverage and savings on fuel.

Plus, cards that provide multi-network coverage come at a premium. So, if you compare the cost of accountabl, for example, against the cost of a leading multi-network card, then yes, you’ll save money.

In addition, because of accountabl’s enhanced features, savvy users can find areas of inefficient spending and save money that way.

How do I get a fuel card with no credit check?

It’s pretty simple, apply for accountabl prepaid fleet fuel card.

Book your free demo and try it for 30-days free.

No credit checks are performed, simply a ‘know your business’ check to verify if you’re a registered company.

That’s all there is to it.