Have you heard siren call of business credit cards?

It's a common way to manage expenses, but that doesn’t mean they’re the best way. Keep reading to get the facts and to find the best solution for your company.

What are they?

Company credit cards are exactly what sound like, they’re credit cards designs for businesses. They’re generally used to purchase supplies, for incidental expenses. and travel.

There are broadly two types of business card.

1. Individual liability cards

These cards are paid off by the worker, who then reports their expenses to their employer for reimbursement.

The credit card issuers ask workers for their personal credit score before approval, but their personal credit score isn’t affected by the card purchases they make.

2. Corporate Liability Cards.

The credit balance is on these cards, is the responsibility of the company. Employers must pass a credit check to qualify for corporate liability cards. And their funds are taken to pay off any card debt.

When workers use these cards, they need to report their expenses to their employer.

Benefits of business credit cards

With a wide range of benefits, for both companies and workers, it’s not hard to see why business credit cards are popular with around 500,000 open accounts in the UK in 2018.

Maintain cashflow

If your staff need to travel or spend frequently, your cashflow position can be impacted. But business credit cards can help, by allowing you to buy now and pay back later.

In contrast, other expense solutions tend to be prepaid, so you’ll have to upload a month’s worth of expenses in advance which can be tough for companies with a tight cash flow.

Empower workers

Business credit cards, whether individual or corporate liability, allow staff to buy what they need for work without asking for funds or being out-of-pocket. Helping workers, who lost out on £962 million in the UK reimbursements in 2018.

Being out-of-pocket hurts staff, and while they aren’t going to leave over a single expense dispute or late reimbursement, anything that decreases happiness can increase turnover, which is the last thing you need when hiring is a major challenge for near 75% of UK businesses.

More visibility than petty cash

In contrast to outdated expense processes like petty cash, business credit cards come with statements so you can see what was purchased, where, and when. So, it’s easier to see your team’s spending, and you don’t need to worry about missing receipts as much.

Interest-free credit

Depending on the issuer, you can get up to 59 days of interest-free credit. And if you clear your balance every month, then you won’t pay any interest.

Business credit card perks

Business credit cards can come with rewards and perks including reward points, cashback, no foreign transaction fees on purchases abroad, and discounts with participating retailers

Depending on the provider employee cardholders can also benefit from airport lounge access, baggage insurance, and other travel benefits.

Why it’s time to say goodbye

Just because business credit cards are popular, doesn’t mean they’re the best expense management solution for companies. Times are changing, and solutions need to keep up.

Limited control

If you use company credit cards, you depend on your workers remembering your expense policy, and choosing to follow it.

While you can set spend limits, you can’t set category limits and have manager approvals to ensure that employees follow rules, like you can with more advanced expense management solutions.

Lacks integrations

While some do, many business credit card web interfaces don’t connect to accounting packages. And for interfaces that do connect, unlike expense solutions, there’s no pre-conciliation to categories.

It's hard to communicate with providers

Business credit cards with favourable benefits, perks, and rewards, generally come from bigger companies. However, when things go wrong many organisations find it difficult to get the help they need.

Employees need to report their expenses

With both individual liability and corporate liability cards, card users need to report their expenses so that VAT can be reclaimed. Which is frustrating for both workers, and for finance teams who might end up chasing after missing receipts.

Risk of fraud

According to UK Finance, in 2020, fraud losses on UK cards totalled £574.2 million.

Because you can’t see what workers are spending in real-time and there are no approval workflows, there is a higher risk of expense fraud with business credit cards compared to expense management solutions.

Lacks advanced features

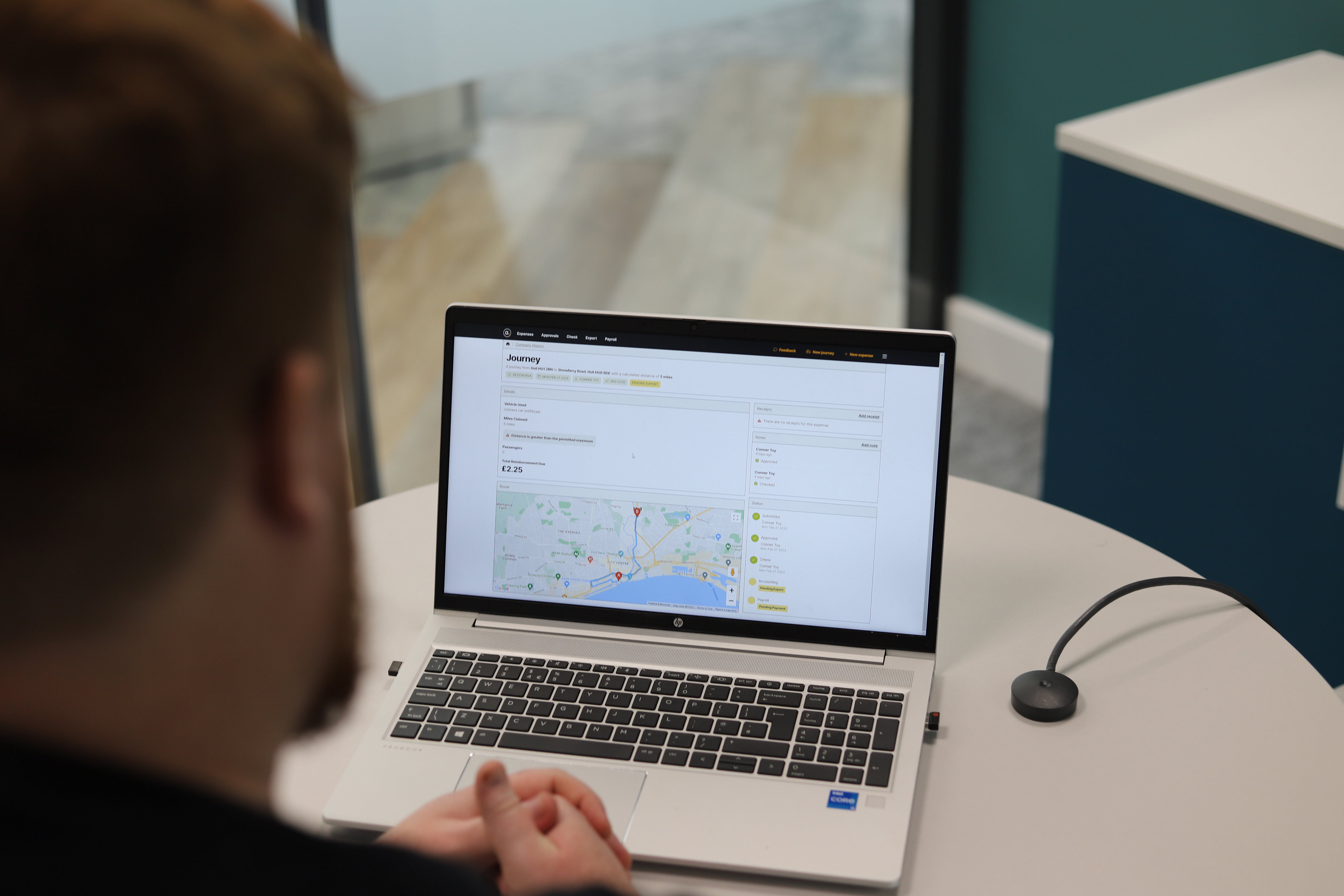

Unlike expense management systems, business credit cards don’t have advanced features like approval workflows, digital receipt capture, virtual cards, and mileage tracking, making it more difficult to control spending.

Doesn’t help businesses meet sustainability challenges

While lots of issuers are taking climate action, the cards themselves don’t support sustainability even though every business process has a role to play.

This is especially true, giving the increasing number of governments introducing mandatory carbon reporting for companies. In 2022, the UK launched a climate reporting scheme for large companies and Limited Liability Partnerships (LLPs). It’s expected that reporting requirements will also apply to SMEs in the future.

Business credit cards fail to track the environmental impact of spending. So, companies must use separate, often difficult to use, carbon accounting systems to monitor their emissions.

To learn more about sustainable expense management, check out our free guide.

The future of expense management

The zeitgeist is changing, and business credits can no longer keep up with the challenges that companies face. Not only do they lack the control businesses need in a tough economy, but they also fail to account for sustainability, the growing pressure on firms to disclose their carbon footprint, and the merging of financial and emissions reporting.

Fortunately, platforms like accountabl are stellar business credit card alternatives, merging advanced expense management features with carbon tracking. Giving companies the real-time visibility and control they need to manage their expenses, and prevent waste and fraud, while starting their eco-journey.

So, it’s easier and more affordable to manage expenses and start making more sustainable decisions than ever before. See for yourself and start your 30-day free trial of accountabl.